This essay started life as a short talk on a panel at a critical finance studies conference. It sought to address the panel’s theme of Covid and financial crisis, specifically how we can understand the sort of generalised economic collapse attendant on the blows to production and consumption caused by the pandemic, and by the various effective or less effective, and generally poorly co-ordinated measures – at least in the UK and US – to deal with it. The phenomenon I began with is something that’s been featured a lot lately, both in finance and non-specialist commentary, and that’s the great divergence between the fortunes of the financial markets, volatile as they are, and actual economic prospects, which are currently reliably accelerating trends of unemployment and business failure, especially in the retail and service sectors which comprise the bulk of the UK economy, and which was most exposed to the economic and behavioural changes attendant on pandemic control measures. With the caveat that, without much fanfare, the financial services industry is often included in the service sector, certainly in UK national accounting, and that this element is hostage to a very different set of fortunes than the financial district café.

The programme I convene and teach at Goldsmiths is a Masters’ in Culture Industry (an ambiguous title which affords a certain level of critical autonomy) focuses on the gaps between the resilience of ideologies of creativity in the economy and the actual precarity of working conditions that are either glorified or denounced as inseparable from this economy. Here we could think specifically of the ‘cultural industries’ such as contemporary art, fashion, music, design, digital entrepreneurship, and in the class we spend a lot of time discussing divergences between success ideology and empirical failure, and how part of the systemic character of that failure is not only the erosion of social institutions like the welfare state or global trends of financialization, underdevelopment, wage arbitrage, and industries of extraction from dispossession of land to the harvesting of data. In addition, and in some ways fundamentally so, there is psychic extraction, or, the individualisation of responsibility, of blame, for economic failure as personal failure, as the inability to sufficiently leverage or mobilise your own human and social capital: the (ostensible) impossibility of collective action in an industry driven by personal branding (unless that action can in turn be branded). What this means, and it is vital to articulate it in such terms, is that the creative subject is the most brutalised of all capitalist subjects, since not only is competitive and mendacious behaviour inculcated as employability, but the subject’s right to engage in such behaviour is justified in terms principally transcendent of the economy and survival motives: creativity, inspiration, magic. The creative industries should thus be considered as unfiltered – if not more – playgrounds of capitalist theology as the financial industries, which at least often host subjectivities convinced they are in it for (usually personal) reasons other than to further the fortunes of finance as a moving spirit of progress in the world.

However, coming back down to earth somewhat, it remains to be noted that the ambience of the ‘cultural industries’ and the fate of the finance industry can be understood as the exuberance of the market and the depression of social reproduction as a structural principle of the economy we currently inhabit. Between these there is not just a divergence, to be sure, but a dependence, a state of affairs that terms like the ‘financialization of social reproduction’ in its role as a key aspect of neoliberal governance, have framed. As philosopher Katerina Kolozova writes in her analysis of how philosophical and financial speculation have joined forces, ‘The finance industry is now alive and well, in perfect detachment from the material or use worth, whereas its material resources are progressively impoverished and marked for destruction’.1 This is a point borne out dazzlingly by the ‘great divergence’ between a glorious market and a sick and fragile society we’ve had the opportunity to observe in the last months.

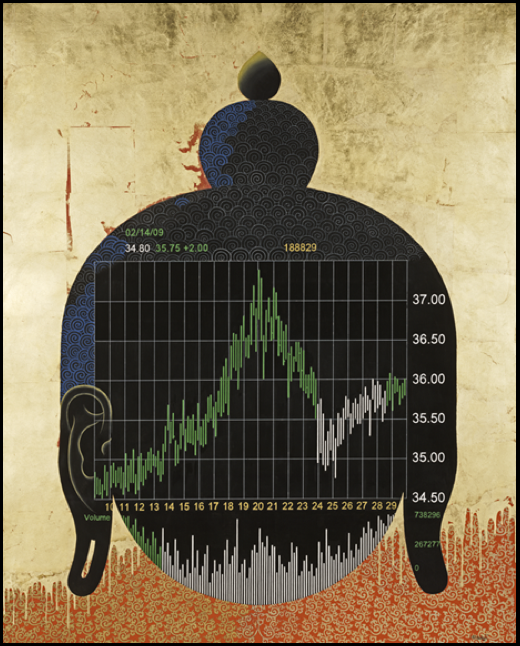

Derivative-Tsherin Sherpa, Courtesy of the artist and Rossi and Rossi

Concomitantly, in the course, we look at questions around ‘intellectual property’ and the last few decades of proposals around dis-intermediation in this field, such as free software, peer-to-peer, creative commons or blockchain, and how none of this can be made sense of without a grounded understanding how capitalist private property rights have been institutionalised so as to create inclusion and exclusion as the core principles of creativity but also personhood as such. This is patently (sorry for the pun) a logic driving these operates across scales to make the social hierarchies of wealth and resources optimal to the logic of property as neutral, natural and universal principles that work to everyone’s benefit, instead of operating as a logic of inequality, deprivation, and murder, starting by how access to the very status of the human, of a life worth perpetuating instead of waste that needs clearing up, operating ubiquitously through the axiom of ‘whiteness as property’, along the chain of signifiers of freedom, creativity and exceptionality indicated already.

So given all this, you’d think that it would be precisely the closer entanglement between the mythical ‘real economy’ of production and reproduction that’s been so badly distorted by the pandemic and the financial markets, that would assign them a unitary fate rather than a great divergence. That would seem like the intuitive conclusion to draw. But that’s not what’s happening. So what we’re actually seeing is how the value extracted from productive and reproductive activities – which can also be approached through the lens of consumption, of course, particularly the credit-based consumption that is in many places, certainly the U.S, one of the only forms of access to many of the types of social reproduction we can think of, such as health, housing and higher education, not to mention, on a larger scale, local government, as is the case in many other places – is sucked up into the operations of financial markets. They then proliferate this value through transactions entirely internal to the trade of financial instruments, often completely automated and acting on micro-margins of time, risk and movements in valuation – and which are based on a likewise completely endogenous market sentiment, a sentiment that is flattered and enthused rather than concerned by social collapse, as we’re seeing in the US right now, so long as you have a favourable legislative and technical climate for the regulation, or de-regulation rather, of the financial markets, and domestic politics is only one ingredient in this climate, albeit in a place like the U.S. quite a significant one, just as the movements of the Fed have an outsize impact everywhere else in the world as well. And of course this is replicated in the relationship of financial markets to the escalating signs of ecological collapse. Finance has simply developed – been allowed to develop – to a state where it is functionally insulated from the catastrophic consequences of social and ecological tendencies it has in part institutionalised, rewarded and found ways to profit from for a long time. And it’s clear that, all messaging and tinkering around disinvestment and green finance aside, the dimming insurance prospects for hydrocarbon extraction, etc., the only set of mechanisms that can address this functional insulation, and the divergence that it enables, would be political ones, which is of course an argument that’s been made for a long time, and in many parts of the political spectrum, not only the environmental movement, although from there it’s probably been most obvious that market mechanisms were having precisely zero effect, systemically speaking, on halting or reversing the worst, and on facilitating better, ways for humanity to relate to its planetary parameters. Likewise, in this scenario the notion of an agential humanity does nothing but obscure the historically, socially and racially skewed monopolies on violence that maintain and accelerate these forces of accumulation by destruction. Which is also why I’m glad we are hearing a little bit less of that catch-all term ‘Anthropocene’ these days, even if that can also be attributed to the vagaries of academic micro-trends. Pertinent here is Jason Moore’s observation that ‘[we must] refuse the mode of thought that tells us the world can be understood, and acted upon, through the doubly violent abstractions of Humanity and Nature. The bloodstains on these concepts-and the system of Cheap Nature that produced them-simply cannot be bleached out.’2 In this light, the notions of human capital that pervade cultural and creative industries discourse both advance the omnipotence of the ‘creative’ as self-owning genius, and their integration with capital-as-nature. This is oddly reminiscent of Moore’s formulation, while wholly remote from its diagnostic intent. In this strange convergence-divergence, we see an emulation of the larger tendency sketched out above: the integration of social reproduction with the financial industry, even as the financial industry powers ahead on its own path, flush with its own mythos of wealth creation. An extended analysis would need to parse this double movement in terms of different moments in the circuit of valorisation (profits generated in exchange as fictitious capital, as outlined in the next section) while surplus value created by labour, waged or unwaged, human or geophysical, is extracted further down the line), but this would need to be done elsewhere.

However, in the discussion of the ‘great divergence’ between financial markets and the (extensively financialised) ‘real’ economy, including the creative one, it would be important to point out that the heavy state support, use of lowered interest rates, quantitative easing, stock buybacks, and other techniques that have kept the markets inflated and shooting into the stratosphere, have also imparted to the markets a wholly different temporality than the rest of the economy and social life. In the latter, the march of time is relentless and it doesn’t usually bode well – more debt, more illness, more trouble accessing services, more state violence and less – room to manoeuvre, resources, and all the rest of it. This is time taking its toll, and the forward movement of a time that highlights the circumstances in which most people have no agency. This diminution occurs despite the feeling of stalling or looping that attend on the restricted conditions of lockdown and the intermittent, punishing crawl of Covid time. For the markets and everyone who profits from them, time has, thankfully, stopped, because they are insulated from all social reality, and whatever happens, their magnitude is on a scale that will feel no repercussions. The divergence from reality and its temporalities is of course anticipated in Marx’s term for the finance industry, ‘fictitious capital’, the transmutation of paper claims on value into further claims, their connection to any surplus value produced in any part of the economy growing increasingly tenuous. This makes all processes of valuation in the financial markets endogenous and self-referential, or, as Kolozova puts it, comprised of speculation on their ability to ‘rank, estimate, evaluate, predict, create, and control processes in the financial market.’3 Fiction inhabits its own space and time, and the conditions that perpetuate the fiction happen to be the same conditions that impoverish reality for its benefit – thus situating divergence as dependence, dependence in divergence.

But beyond the fetishistic, digitally modulated time of finance, is there something to be added here about capitalist temporality in a more basic sense, one that implicates and interpellates labour, making it act in favour of the kind of divergence between financial values and the decline of use values and some forms of exchange value? Rather than looking directly to the epiphenomenon of finance as a politically empowered branch of authoritarian neoliberalism, we can see it as a symptom or hypostasis of reproducing some systematic features of capitalism as a social relation (abstraction, dispossession, domination of human and non-human labour and energy) on a more iconic scale, one which decades ago was in part dissembled by the apparent use-value orientation of manufacturing industry – a dissimulation that is never far behind whenever a ‘real economy’ is juxtaposed to a fictitious one. In the same way, the pandemic is an especially iconic and communicative way of representing the form this ‘real’ had developed under the current phase of economic and biopolitical extraction, from nature to social institutions. Moishe Postone’s account of temporality as a mode of capitalist accumulation sheds some light on this. In his reconstruction of the emergence of ‘abstract time’ in the proto-capitalist cloth manufacturing centres of late medieval Northern Europe, he defines abstract time as time as an independent variable that regulates activity, as opposed to a ‘concrete time’ that is measured by activity, such as monastic tasks or prayer cycles, or the types of labour to be performed between sunrise and sunset. Abstract time became important as the working day became an issue for an emergent class of post-guild wage labourers and owners, while the duration of goods in transit became a key variable in the price market for those goods. Thus, the ascendancy of ‘commodity relation’ in production and circulation of goods augured the dominance of abstract time as it became the measure of value produced according to quantities of labour time and the intensity of this labour. Nowadays of course, the texture of labour time changes again owing to the gradual ebbing away of regulation by time to regulation by quantity in the return to ‘piece-work’ characteristic of the digital monopolies and the gig economy, and the multiple forms of warehouse, transport and personal service labour that take place under its auspices. In this regard, the abstraction of time that produce time-based wages almost seems preferable, inasmuch as it provides a modicum of comparability which can be standardised and regulated, whereas piece-rates almost seem to re-introduce a type of ‘concrete domination’ that cut the worker loose from any obligation on the part of their employers or state agencies, their success or starvation rendered entirely a factor of their own ‘productivity’. Such a despotically imposed ‘personalization’ of survival as profit-making activity on someone else’s behalf is a good sketch of the majority of the working and living conditions on the other side of the ‘divergence’ where we located finance. A futuristic and wholly endogenous mode of accumulation on one side, and debt-bonded dead-end service work on the other. This resonates with debates about ‘neo-feudalism’ and the ‘stagnation’ that typifies our allegedly future-oriented economy. More explicitly, it articulates two different forms of temporality within the abstract time Postone outlines as the core of capitalist social relations. Abstract time congeals in transactions in the financial markets and becomes a commodity in its own right, enclosing all development in speculation on sub-detectable price movements increasingly tracked by automated agents. On the other side, the abstract time discipline of the wage breaks down in the individualised and despotic relations of forced entrepreneurship or the contingent contract, where the fictional equality of the exchange of labour power for a wage that Marx diagnosed as the cover story of the power imbalance between worker and owner which only ‘force decides’ itself starts to evaporate, while the violence of force is internalised by the worker, usually cut off from any collective or institutional means of redress – a process well encapsulated in the human capital ideology that traverses all precarious work, but is most naturalised in the creative fields. Concrete time and abstract time, just like concrete and abstract labour, are emergent properties of the capitalist form of value as the prism through which all social reasons pass; not opposites, but tendencies in tension. The workforce can sicken, retreat, die but the health of the markets is unaffected. The economy can drown in a cesspool of bad debt; the financial markets have all their bets covered, backed up by the infinite largesse of the state which is motivated to mis-identify them as one entity with the economy. Perhaps this is the triumph of abstraction, even and at the same time as it takes on a different guise: the eradication of any barriers to a concrete domination that is often embraced by those whose lives will always remain disposable for it, at the level of work relations, as well as the production of subjectivity, biopolitical manipulation and the sacrifice of a living world. The astronomical capacities for harm inherent to capitalism as a ‘mode of production’ of nature and life as well as commodities (Moore), the arbiter of their value and non-value, cannot be countered by the moral diction invariably deployed against it. It is clear what is necessary, but impossible to know what it will take. Only that no possibility can subsist without solidarity.